Have you ever wondered why workplace/group savings (cooperatives) beat saving individually? 🤔

Here’s how I explain it:

Personal Savings

You earn interest on money you save with your bank or other institution. But many of them have conditions that force you to forfeit cash whenever you withdraw from them during an emergency.

Emergency situations are never planned for. However, you’ll be penalized for it.

After you have collected your savings, you will need to verify that inflation rate has not led to a loss.

Group Savings (Cooperatives/Associations/Families/Friends)

The difference is that you can borrow up to x2 what you’ve saved as a loan when you need money for emergencies in a group or cooperative. In addition, this money is not taken from your savings but is taken from funds held in a group account at very low interest rates.

After payment of the loan is completed, you will still have ALL of your savings + interest accrued on it + dividends shared within the group.

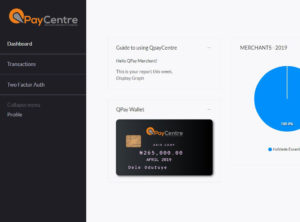

Additionally, you can buy products at great discounts from top merchants through QOOP. 💪